As we approach the end of the year, it's time to buckle up and focus on year-end accounting. Whether you're a small business owner, an entrepreneur, or someone managing personal finances, closing out your books properly is crucial. This process isn't just about ticking boxes—it's about ensuring you have a clear picture of your financial health and setting the stage for success in the upcoming year.

End of year accounting might sound intimidating, but it doesn't have to be. Think of it as a financial cleanup—like organizing your closet but with numbers. You'll declutter your books, identify any discrepancies, and prepare for tax season. Plus, who doesn't love a fresh start?

In this guide, we'll break down everything you need to know about year-end accounting, from the basics to advanced tips. We'll cover what to do, why it matters, and how to make the process as painless as possible. Let's dive in!

Read also:Is Brandon Flynn Gay Unpacking The Truth Behind The Rumors

What is End of Year Accounting Anyway?

Let's start with the basics. End of year accounting refers to the process of reviewing, reconciling, and finalizing your financial records for the year. It's like giving your finances a thorough checkup before ringing in the new year. This process is essential for businesses and individuals alike because it helps you understand where you stand financially.

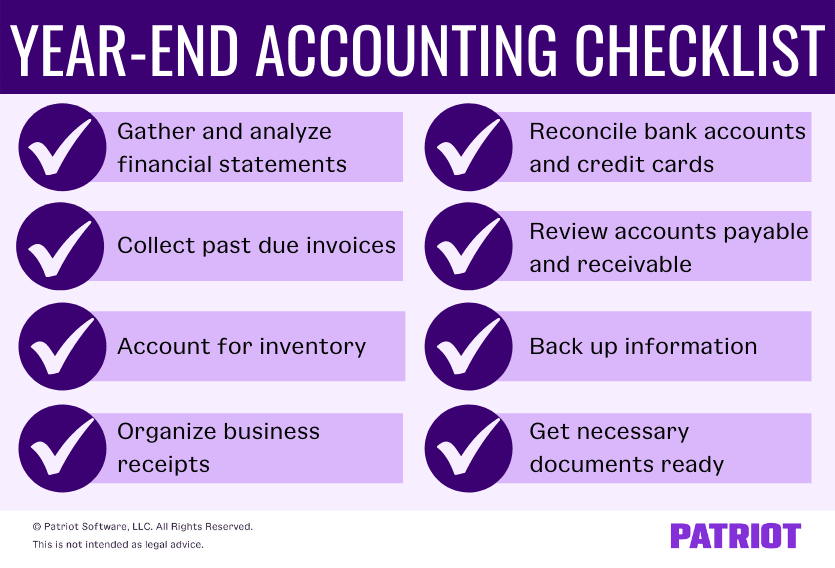

Here are some key activities involved in end-of-year accounting:

- Reconciling bank statements

- Preparing financial statements

- Adjusting journal entries

- Reviewing accounts payable and receivable

- Preparing for tax filings

It's not just about numbers; it's about making informed decisions for the future. By wrapping up your finances properly, you can identify areas for improvement and set realistic goals for the year ahead.

Why End of Year Accounting Matters

Okay, so you might be thinking, "Why does this matter so much?" Well, here's the deal: end of year accounting isn't just a formality—it's a critical step in maintaining financial health. It helps you:

- Ensure accuracy in your financial records

- Identify potential tax deductions

- Plan for the future with confidence

- Avoid costly mistakes that could lead to audits

Think of it this way: if you don't take care of your finances now, you'll end up paying for it later—literally. By dedicating time to end-of-year accounting, you're investing in your financial well-being.

Common Challenges in End of Year Accounting

Now, let's talk about the hurdles you might face when wrapping up your finances. Don't worry; they're not as scary as they sound. Here are some common challenges and how to tackle them:

Read also:Katia Washington Unpacking The Truth Behind The Headlines

1. Incomplete Records

Missing receipts or unrecorded transactions can wreak havoc on your year-end accounting. To avoid this, make it a habit to keep detailed records throughout the year. Use accounting software or spreadsheets to stay organized.

2. Misclassifications

Classifying expenses incorrectly can lead to errors in your financial statements. Double-check your entries and consult with an accountant if you're unsure about certain categories.

3. Time Constraints

With the holidays and other commitments, finding time for year-end accounting can be tough. Start early and break the process into smaller tasks to make it more manageable.

Step-by-Step Guide to End of Year Accounting

Ready to get started? Here's a step-by-step guide to help you navigate the end-of-year accounting process:

Step 1: Gather All Necessary Documents

Collect all the documents you'll need, such as bank statements, invoices, receipts, and payroll records. Having everything in one place will save you a ton of time and hassle.

Step 2: Reconcile Your Accounts

Reconciling your accounts ensures that your records match your bank statements. This step is crucial for identifying discrepancies and correcting errors.

Step 3: Prepare Financial Statements

Create your balance sheet, income statement, and cash flow statement. These documents provide a snapshot of your financial performance for the year.

Step 4: Adjust Journal Entries

Make any necessary adjustments to your journal entries, such as recording depreciation or allocating expenses. This step ensures that your financial records are accurate and up-to-date.

Step 5: Review Accounts Payable and Receivable

Take a close look at your accounts payable and receivable to ensure all payments are recorded correctly. Follow up on any outstanding invoices to avoid losing revenue.

Step 6: Plan for Taxes

Gather all the information you'll need for tax filings, such as income statements, expense reports, and W-2 forms. Consult with a tax professional if you're unsure about certain aspects.

Tools and Software for End of Year Accounting

In today's digital age, there are plenty of tools and software to help streamline your end-of-year accounting process. Here are some popular options:

- QuickBooks

- Xero

- Wave

- FreshBooks

These platforms offer features like automated reconciliations, invoicing, and financial reporting, making your life much easier. Plus, they integrate with other apps to enhance functionality.

Best Practices for End of Year Accounting

Here are some best practices to keep in mind as you tackle your end-of-year accounting:

- Stay organized throughout the year

- Set aside dedicated time for the process

- Seek professional help if needed

- Review your work for accuracy

By following these tips, you'll be well on your way to a stress-free year-end accounting experience.

Tips for Small Businesses

If you're a small business owner, here are some additional tips to help you with year-end accounting:

1. Focus on Cash Flow

Cash flow is the lifeblood of any business. Make sure you have a clear understanding of your cash inflows and outflows to ensure financial stability.

2. Review Your Budget

Compare your actual expenses with your budget to identify areas where you can improve. This will help you create a more realistic budget for the upcoming year.

3. Plan for Growth

Use your year-end accounting data to inform your growth strategies. Identify opportunities for expansion and allocate resources accordingly.

End of Year Accounting for Individuals

Don't think end-of-year accounting is just for businesses. Individuals can benefit from this process too. Here's how:

1. Review Your Investments

Take a look at your investment portfolio to ensure it aligns with your financial goals. Rebalance if necessary to minimize risk.

2. Prepare for Tax Season

Gather all the documents you'll need for tax filings, such as W-2s, 1099s, and receipts for deductions. This will save you time and stress when tax season rolls around.

3. Set Financial Goals

Use your year-end accounting data to set realistic financial goals for the upcoming year. Whether it's saving for a vacation or paying off debt, having clear objectives will keep you motivated.

Conclusion

End of year accounting might seem daunting, but with the right approach, it can be a smooth and rewarding process. By following the steps outlined in this guide, you'll be able to wrap up your finances with confidence and set the stage for success in the new year.

So, what are you waiting for? Get started on your end-of-year accounting today! And don't forget to share this article with your friends and colleagues who might find it helpful. Together, let's make financial health a priority.

Table of Contents

- What is End of Year Accounting Anyway?

- Why End of Year Accounting Matters

- Common Challenges in End of Year Accounting

- Step-by-Step Guide to End of Year Accounting

- Tools and Software for End of Year Accounting

- Best Practices for End of Year Accounting

- Tips for Small Businesses

- End of Year Accounting for Individuals

- Conclusion