Investing can be a wild ride, and understanding the right metrics is like having a treasure map to guide you through the chaos. When it comes to evaluating investment performance, two terms often pop up: ROI and IRR. But what do they really mean? Why should you care? And which one reigns supreme in the world of finance? Let's dive deep into this thrilling battle of ROI vs IRR and uncover the secrets that make them so powerful.

Picture this: you're standing at a crossroads, trying to decide whether to pour your hard-earned cash into a new business venture, real estate, or stocks. The stakes are high, and you need more than just gut feelings to make the right call. That's where ROI and IRR come in. They're like the dynamic duo of investment analysis, but they approach things in very different ways.

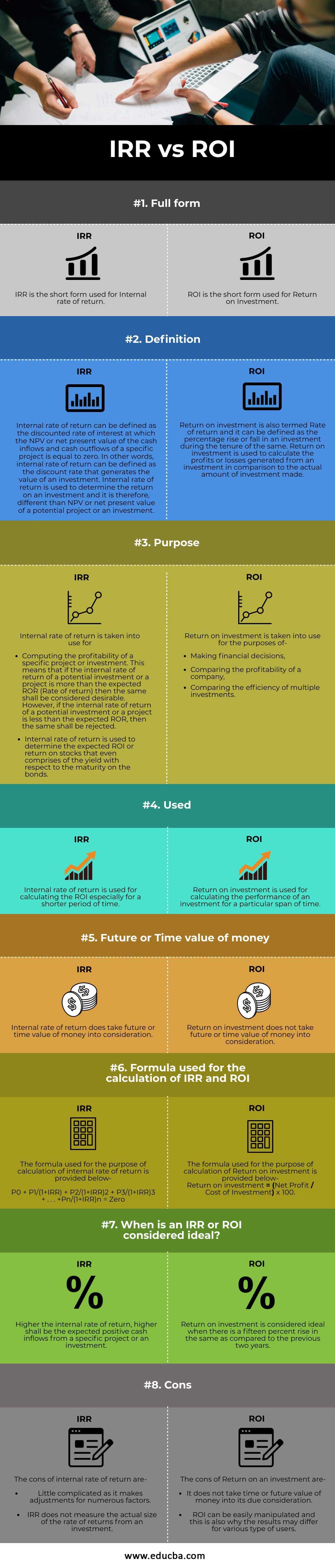

Now, before we get into the nitty-gritty, let's clear the air. ROI (Return on Investment) and IRR (Internal Rate of Return) are both crucial tools for assessing how well your investments are performing. But they serve different purposes, and understanding their strengths and limitations is key to making smart financial decisions. So buckle up, because we're about to take a deep dive into the world of ROI vs IRR!

Read also:Phil Dunster Height The Inside Scoop On The Man Behind The Measurements

What is ROI?

Let's start with the OG of investment metrics: ROI. Think of ROI as the simplest way to measure how much bang you're getting for your buck. It's a straightforward calculation that compares the profit or loss from an investment to the amount of money you initially put in. In other words, ROI tells you whether your investment is worth it or if you'd have been better off buying a lottery ticket.

Here's the basic formula: ROI = (Net Profit / Cost of Investment) x 100. Easy peasy, right? The beauty of ROI is its simplicity. Whether you're flipping houses, trading stocks, or starting a business, ROI gives you a quick snapshot of your investment's performance. But don't let its simplicity fool you – ROI is a powerful tool that can help you make informed decisions.

Why ROI Matters

ROI matters because it's like the universal language of investing. Investors, entrepreneurs, and business owners all use ROI to gauge the success of their ventures. It's a quick and dirty way to compare different investments and figure out which ones are worth pursuing. Plus, it's easy to calculate, which makes it accessible even for those who aren't finance wizards.

For example, imagine you're deciding between two potential investments: a tech startup and a rental property. The tech startup has an ROI of 20%, while the rental property has an ROI of 15%. At first glance, the tech startup seems like the better choice. But hold your horses – there's more to the story than just numbers.

What is IRR?

Now let's talk about the more complex cousin of ROI: IRR. Think of IRR as the Sherlock Holmes of investment metrics – it's all about uncovering the hidden truths behind your cash flows. IRR measures the annual growth rate of an investment, taking into account the timing and size of cash inflows and outflows. In essence, it tells you how much your money is really growing over time.

The formula for IRR is a bit more complicated, but don't worry – you don't need a PhD in math to understand it. Essentially, IRR calculates the discount rate that makes the net present value (NPV) of all cash flows equal to zero. Yeah, it sounds like a mouthful, but it's basically a way to figure out the true rate of return on your investment.

Read also:Hottest Playmates A Dive Into The World Of Playboys Glamorous Icons

Why IRR is Different from ROI

So why does IRR matter? Well, unlike ROI, IRR takes into account the time value of money. This is a big deal because a dollar today is worth more than a dollar tomorrow. IRR helps you understand how your investment performs over time, which is especially important for long-term projects or complex financial deals.

For example, imagine you're investing in a renewable energy project that requires a significant upfront cost but generates steady cash flows over the next 10 years. ROI might give you a quick snapshot of the project's profitability, but IRR will give you a more accurate picture of how your money is growing year after year.

ROI vs IRR: Key Differences

Now that we've covered the basics of ROI and IRR, let's break down the key differences between these two investment metrics. Understanding these differences is crucial if you want to make the right financial decisions.

- Time Factor: ROI doesn't consider the time value of money, while IRR does. This means IRR gives you a more accurate picture of how your investment grows over time.

- Complexity: ROI is simple and easy to calculate, making it perfect for quick comparisons. IRR, on the other hand, is more complex and requires a deeper understanding of cash flows and discount rates.

- Scope: ROI works best for short-term investments or simple projects, while IRR is ideal for long-term or more complex investments.

When to Use ROI vs IRR

Knowing when to use ROI vs IRR can make all the difference in your investment strategy. Here's a quick guide to help you decide:

- Use ROI: When you need a quick and simple way to compare different investments or evaluate short-term projects.

- Use IRR: When you're dealing with long-term investments or complex financial deals that involve multiple cash flows over time.

Limitations of ROI

As powerful as ROI is, it's not without its limitations. One of the biggest drawbacks of ROI is that it doesn't take into account the time value of money. This means it can give you a misleading picture of an investment's true performance, especially if the investment spans several years.

For example, imagine you have two investments: one with an ROI of 10% over one year and another with an ROI of 20% over five years. On paper, the second investment looks better, but when you factor in the time value of money, the first one might actually be the better choice. That's where IRR comes in to save the day!

How to Overcome ROI's Limitations

While ROI has its flaws, there are ways to overcome its limitations. One approach is to use ROI in conjunction with other metrics, like IRR or NPV. This gives you a more complete picture of your investment's performance and helps you make more informed decisions.

Another tip is to always consider the context of your investment. Is it a short-term or long-term project? Are there other factors at play, like market conditions or economic trends? By taking a holistic view, you can get a better understanding of how ROI fits into the bigger picture.

Limitations of IRR

Just like ROI, IRR isn't perfect. One of the biggest limitations of IRR is that it assumes all cash flows are reinvested at the same rate of return. In reality, this rarely happens, which can lead to inaccurate results. Additionally, IRR can sometimes produce multiple solutions or no solutions at all, especially in cases where cash flows change direction multiple times.

For example, imagine you're evaluating a project with an initial outlay followed by a series of positive and negative cash flows. IRR might give you two different rates of return, making it difficult to determine which one is the true rate of return. This is where NPV comes in to provide a more reliable measure of investment performance.

How to Overcome IRR's Limitations

To overcome IRR's limitations, it's important to use it in combination with other metrics, like NPV or payback period. This helps you get a more accurate picture of your investment's performance and avoid potential pitfalls.

Another tip is to always double-check your assumptions. Are you reinvesting cash flows at a realistic rate? Are there any hidden costs or risks that could impact your results? By staying vigilant and questioning your assumptions, you can make more informed investment decisions.

ROI vs IRR: Which One Should You Choose?

So, which one should you choose: ROI or IRR? The answer depends on your specific needs and the nature of your investment. If you're looking for a quick and simple way to compare investments, ROI is the way to go. But if you're dealing with long-term or complex projects, IRR is the better choice.

That being said, there's no reason you can't use both metrics together. By combining ROI and IRR, you can get a more complete picture of your investment's performance and make more informed decisions. Just remember to always consider the context and limitations of each metric before drawing any conclusions.

Tips for Using ROI and IRR Together

Here are a few tips for using ROI and IRR together:

- Start with ROI to get a quick snapshot of your investment's profitability.

- Use IRR to dive deeper into the time value of money and long-term performance.

- Always consider other factors, like market conditions, economic trends, and hidden costs, when evaluating your investments.

Real-World Examples of ROI vs IRR

To help you understand how ROI and IRR work in practice, let's look at a few real-world examples:

Example 1: A startup founder is deciding whether to invest in a new product line. The initial cost is $100,000, and the expected profit after one year is $120,000. The ROI is 20%, which looks promising. But when the founder calculates the IRR, they discover that the true rate of return is actually 15% due to the timing of cash flows. This helps them make a more informed decision about whether to proceed with the investment.

Example 2: A real estate investor is evaluating two properties: one with an ROI of 15% over one year and another with an ROI of 25% over five years. At first glance, the second property seems like the better choice. But when the investor calculates the IRR, they discover that the first property actually has a higher rate of return due to the time value of money.

Lessons from Real-World Examples

These examples illustrate the importance of using both ROI and IRR to evaluate investments. While ROI gives you a quick snapshot, IRR provides a deeper understanding of how your money is growing over time. By combining these metrics, you can make smarter financial decisions and achieve better results.

Conclusion: Mastering ROI vs IRR

In conclusion, understanding the difference between ROI and IRR is essential for anyone looking to make smart investment decisions. While ROI is a quick and easy way to compare investments, IRR provides a more accurate picture of long-term performance. By using both metrics together and considering the context of your investments, you can unlock the full potential of your financial portfolio.

So what are you waiting for? Start exploring the world of ROI vs IRR today and take your investing game to the next level. And don't forget to share your thoughts and experiences in the comments below. Your feedback helps us improve, and who knows – you might just inspire someone else to become a smarter investor!

Table of Contents

- What is ROI?

- Why ROI Matters

- What is IRR?

- Why IRR is Different from ROI

- ROI vs IRR: Key Differences

- When to Use ROI vs IRR

- Limitations of ROI

- How to Overcome ROI's Limitations

- Limitations of IRR

- How to Overcome IRR's Limitations

- ROI vs IRR: Which One Should You Choose?

- Tips for Using ROI and IRR Together

- Real-World Examples of ROI vs IRR

- Lessons from Real-World Examples

- Conclusion: Mastering ROI vs IRR